Press release - Veldhoven, the Netherlands, November 10, 2022

At the Investor Day meeting on November 11, ASML Holding N.V. (ASML) will update its investors and key stakeholders at its headquarters in Veldhoven, the Netherlands as well as online, about its updated view on demand outlook. President & CEO Peter Wennink and Executive Vice President & CFO Roger Dassen will discuss ASML's long-term strategy, megatrends, demand, capacity plans and business model to support the company’s future growth.

Updated scenarios with opportunities to support ASML's future growth

-

While the current macro environment creates near-term uncertainties, we expect longer-term demand and capacity showing healthy growth.

-

Expanding application space and industry innovation are expected to continue to fuel growth across semiconductor markets.

-

Strong growth rates across markets, continued innovation, more foundry competition and technological sovereignty drive an increased demand at advanced and mature nodes, which is expected to require wafer capacity additions.

-

We plan to adjust our capacity to meet future demand, preparing for cyclicality while sharing risks and rewards fairly with all stakeholders.

-

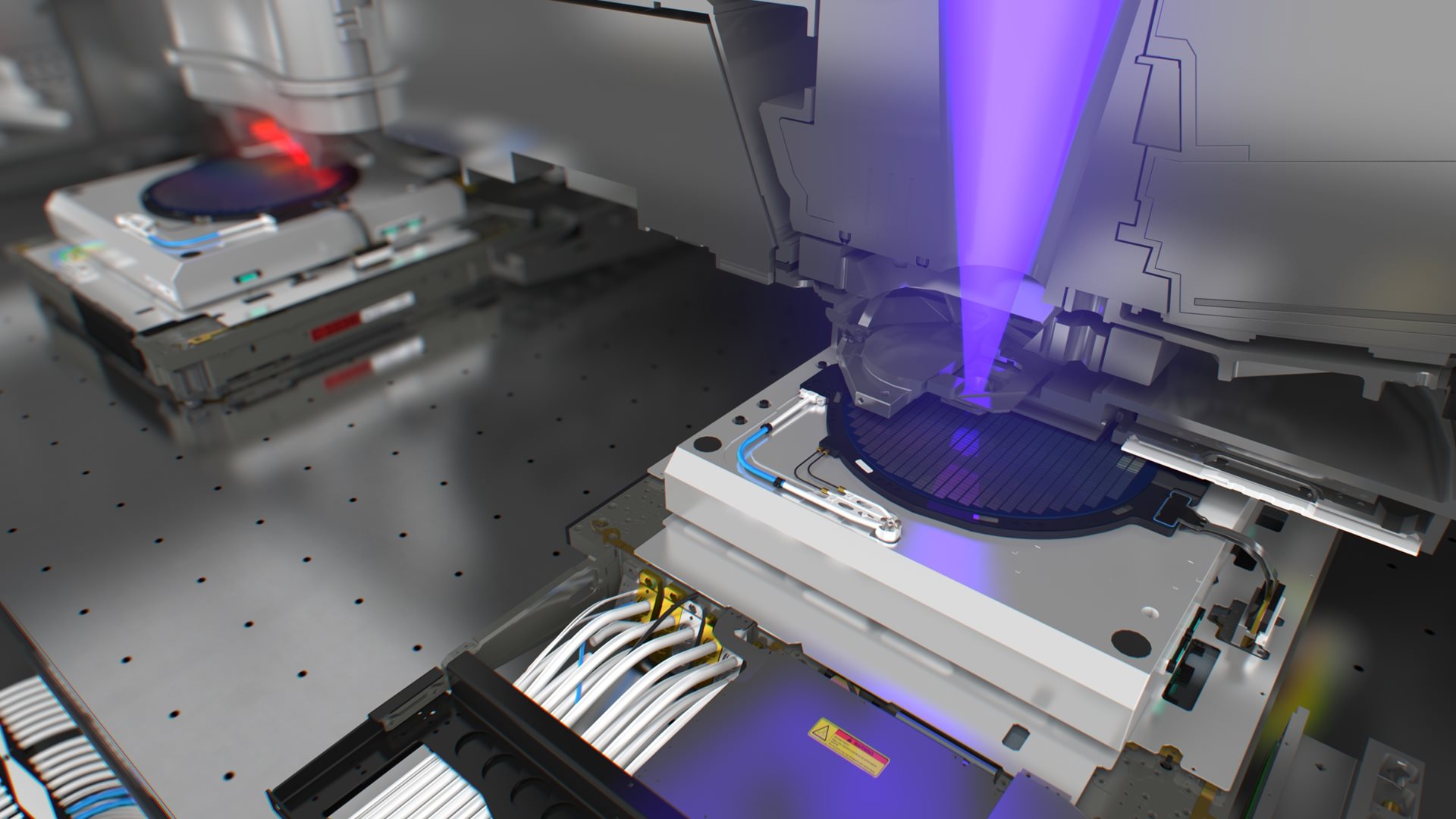

We plan to increase our annual capacity to 90 EUV and 600 DUV systems (2025-2026), while also ramping High-NA EUV capacity to 20 systems (2027-2028).

-

-

Our continued investments in technology leadership have created significant shareholder value. Growth in semiconductor end markets and increasing lithography intensity on future nodes fuel demand for our products and services.

-

These new developments and plans have resulted in updated scenarios for our future growth, compared to the previous Investor Day in September 2021.

-

Based on different market scenarios, we expect a substantial growth opportunity to achieve the following:

-

2025: annual revenue between approximately €30 billion and €40 billion with a gross margin between approximately 54% and 56%

-

2030: annual revenue between approximately €44 billion and €60 billion with a gross margin between approximately 56% and 60%

-

New share buyback program

We expect to continue to return significant amounts of cash to our shareholders through a combination of growing dividends and share buybacks. ASML announces a new share buyback program, effective November 11 and to be executed by December 31, 2025. We intend to repurchase shares up to an amount of €12.0 billion, of which we expect a total of up to 2 million shares will be used to cover employee share plans. We intend to cancel the remainder of the shares repurchased.

The share buyback program will be executed within the limitations of the existing authority granted by the AGM on April 29, 2022 and of the authority to be granted by future AGMs. The share buyback program may be suspended, modified or discontinued at any time. All transactions under this program will be published on ASML's website on a weekly basis.

Webcast and presentations

The Investor Day program on November 11 runs from 13:30 to 16:30 CET. The link to the live webcast can be found on our website (no pre-registration required). The presentations and a recording will be made available afterwards on the website.

About ASML

Regulated information

Forward Looking Statements