Press release - Veldhoven, the Netherlands, January 20, 2016

ASML Holding N.V. (ASML) today publishes its 2015 fourth-quarter and full-year results.

- Full-year 2015 sales were a record EUR 6.3 billion with a gross margin of 46.1%

- Q4 net sales of EUR 1.43 billion, gross margin 46.0%

- ASML proposes dividend of EUR 1.05 per share and announces plan for additional share repurchases of EUR 1 billion in 2016-2017

- ASML guides Q1 2016 net sales at approximately EUR 1.3 billion and a gross margin of around 42%

| (Figures in millions of euros unless otherwise indicated) | Q3 2015 | Q4 2015 | FY 2014 | FY 2015 | ||||

|---|---|---|---|---|---|---|---|---|

| Net sales | 1,549 | 1,434 | 5,856 | 6,287 | ||||

| ...of which service and field option sales | 574 | 553 | 1,613 | 2,050 | ||||

| Other income (Co-Investment Program) | 21 | 21 | 81 | 83 | ||||

| New systems sold (units) | 39 | 32 | 116 | 144 | ||||

| Used systems sold (units) | 5 | 5 | 20 | 25 | ||||

| Average Selling Price (ASP) of net system sales | 22.2 | 23.8 | 31.2 | 25.1 | ||||

| Net bookings* | 904 | 1,184 | 4,902 | 4,639 | ||||

| Systems backlog* | 2,880 | 3,184 | 2,772 | 3,184 | ||||

| Gross profit | 703 | 660 | 2,596 | 2,896 | ||||

| Gross margin (%) | 45.4 | 46.0 | 44.3 | 46.1 | ||||

| Net income | 322 | 292 | 1,197 | 1,387 | ||||

| EPS (basic; in euros) | 0.75 | 0.68 | 2.74 | 3.22 | ||||

| End-quarter cash and cash equivalents and short-term investments | 2,681 | 3,409 | 2,754 | 3,409 | ||||

CEO statement

"Our full-year 2015 net sales marked a new record at EUR 6.3 billion, up from EUR 5.9 billion in 2014, including service and field option sales that rose to a record EUR 2 billion. We expect 2016 first-quarter sales at approximately EUR 1.3 billion. As we indicated three months ago, we expect our logic customers to take shipments of our leading-edge immersion tools in the second quarter in preparation of their 10 nanometer node ramp. As a result, we expect second-quarter sales to increase significantly from the first-quarter level," ASML President and Chief Executive Officer Peter Wennink said.

Product and business highlights

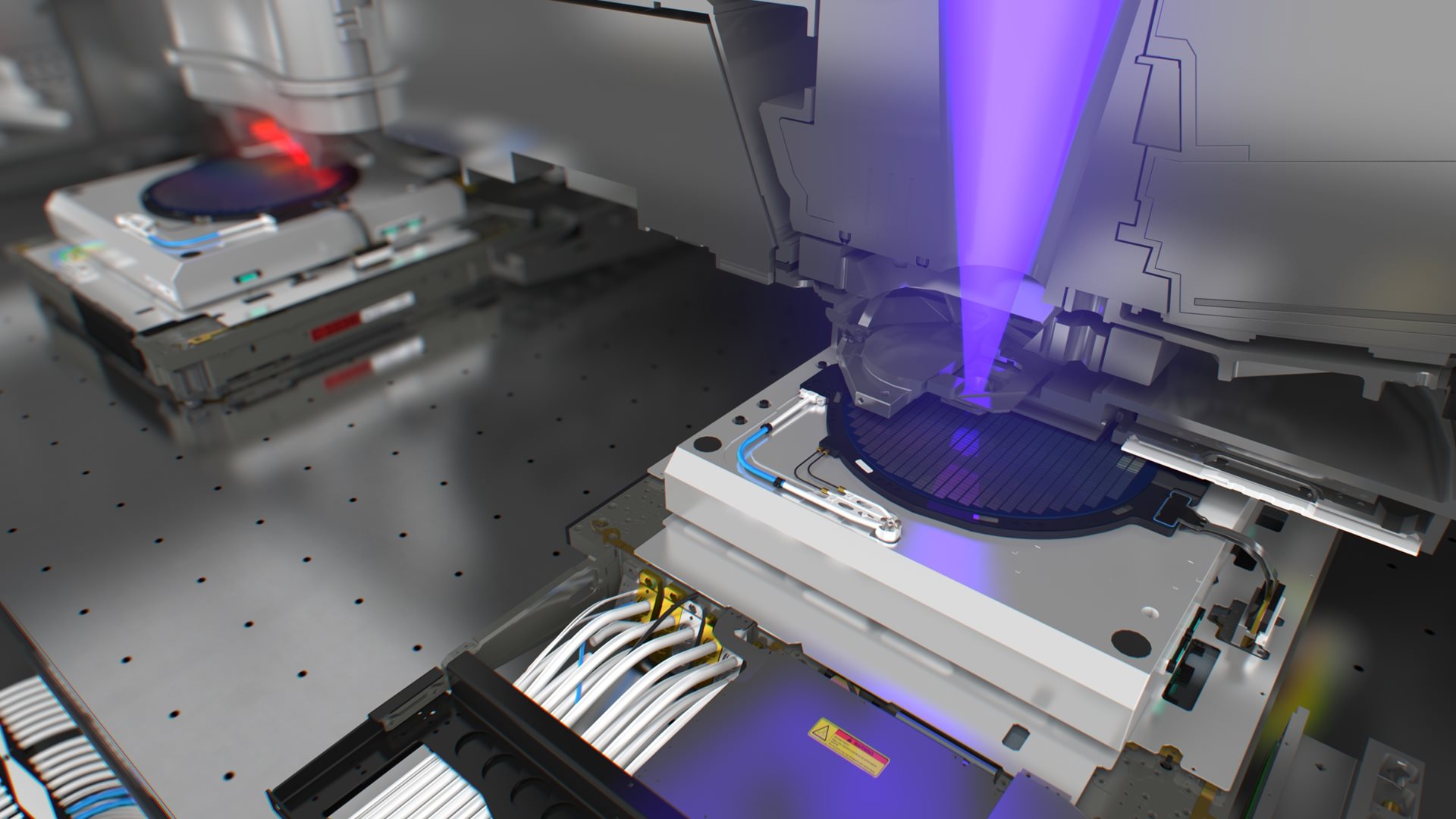

- In Deep-Ultraviolet (DUV) lithography, we began ramping shipments of the TWINSCAN NXT:1980, our most advanced immersion system, in the fourth quarter, shipping five systems. The installation of the first systems is complete.

- In Holistic Lithography, which grew by over 20% in revenue in 2015, we saw increased adoption of our latest metrology systems and control software at both logic and memory customers. These applications play a more and more critical role in helping our customers achieve the best possible patterning performance on advanced nodes.

- Extreme Ultraviolet (EUV) lithography met its 2015 productivity and availability targets. We had already achieved a productivity of more than 1,000 wafers per day early in 2015 on the NXE:3300B system and improved this to more than 1,250 wafers per day in the fourth quarter on the successor system, the NXE:3350B. In addition, the availability of systems in the field improved, with the majority of systems achieving a four-week availability of more than 70% in recent months; the best result was more than 80% over four weeks. We also shipped two of our latest NXE:3350B EUV systems and started shipping the third in 2015. They will be used in our customers' fabs for preparing the introduction of EUV into volume production. Our goals for 2016 are to continue improving productivity and availability and shipping six to seven EUV systems.

Outlook

For the first-quarter of 2016, ASML expects net sales at approximately EUR 1.3 billion, a gross margin of around 42%, R&D costs of about EUR 275 million, other income of about EUR 23 million – which consists of contributions from participants of the Customer Co-Investment Program – SG&A costs of about EUR 90 million and an effective annualized tax rate of around 13%.

Dividend and new share buyback program

In accordance with its financial policy, ASML intends to continue to return excess cash to shareholders on a regular basis through stable or growing dividends and share buyback programs.

Supported by its long term business plan, ASML proposes a dividend per ordinary share which is 50% higher compared with last year. Therefore, we will submit a proposal to the 2016 Annual General Meeting of Shareholders (AGM) to declare a dividend in respect of 2015 of EUR 1.05 per ordinary share (for a total amount of approximately EUR 450 million), compared with a dividend of EUR 0.70 per ordinary share paid in respect of 2014.

ASML also announces a new share buyback program, to be executed within the 2016-2017 time frame. As part of this program, ASML intends to purchase shares up to EUR 1.5 billion, which includes an amount of approximately EUR 500 million remaining from the prior program, announced on January 21, 2015. ASML intends to cancel the shares upon repurchase. This buyback program will start on January 21, 2016.

The share buyback program will be executed within the limitations of the existing authority granted by the AGM on April 22, 2015 and of the authority granted by future AGMs. The share buyback program may be suspended, modified or discontinued at any time. All transactions under this program will be published on ASML's website on a weekly basis.

About ASML

ASML is one of the world’s leading manufacturers of chip-making equipment. Our vision is to enable affordable microelectronics that improve the quality of life. To achieve this, our mission is to invent and develop advanced technology for high-tech lithography, metrology and software solutions for the semiconductor industry. ASML's guiding principle is continuing Moore's Law towards ever smaller, cheaper, more powerful and energy-efficient semiconductors. This results in increasingly powerful and capable electronics that enable the world to progress within a multitude of fields, including healthcare, technology, communications, energy, mobility, and entertainment. We are a multinational company with over 70 locations in 16 countries, headquartered in Veldhoven, the Netherlands.We employ more than 14,000 people on payroll and flexible contracts (expressed in full time equivalents). ASML is traded on Euronext Amsterdam and NASDAQ under the symbol ASML. More information about ASML, our products and technology, and career opportunities is available on: www.asml.com.

Press conference

A press conference hosted by CEO Peter Wennink and CFO Wolfgang Nickl will be held at our office in Veldhoven at 11:00 AM Central European Time / 05:00 AM U.S. Eastern time. An audio webcast of the press conference is available on www.asml.com.

Investor and media conference call

A conference call for investors and media will be hosted by CEO Peter Wennink and CFO Wolfgang Nickl at 15:00 PM Central European Time / 09:00 AM U.S. Eastern time. To register for the call and receive dial-in information, follow the links below. Listen-only access is also available via www.asml.com.

2015 annual reports

ASML will publish its 2015 Annual Report on Form 20-F, Statutory Annual Report, Corporate Responsibility Report and Remuneration Report on February 5, 2016. The reports will be published on our website.

US GAAP and IFRS financial reporting

ASML's primary accounting standard for quarterly earnings releases and annual reports is US GAAP, the accounting principles generally accepted in the United States of America. Quarterly US GAAP consolidated statements of operations, consolidated statements of cash flows and consolidated balance sheets, and a reconciliation of net income and equity from US GAAP to IFRS as adopted by the EU (‘IFRS’) are available on www.asml.com.In addition to reporting financial figures in accordance with US GAAP, ASML also reports financial figures in accordance with IFRS for statutory purposes. The most significant differences between US GAAP and IFRS that affect ASML concern the capitalization of certain product development costs, the accounting of share-based payment plans and the accounting of income taxes. ASML’s quarterly IFRS consolidated statement of profit or loss, consolidated statement of cash flows, consolidated statement of financial position and a reconciliation of net income and equity from US GAAP to IFRS are available on www.asml.com.

The consolidated balance sheets of ASML Holding N.V. as of December 31, 2015, the related consolidated statements of operations and consolidated statements of cash flows for the quarter and year ended December 31, 2015 as presented in this press release are unaudited.

Regulated information

This press release constitutes regulated information within the meaning of the Dutch Financial Markets Supervision Act (Wet op het financieel toezicht).