Press release - Veldhoven, the Netherlands, and San Diego California, US, October 17, 2012

ASML Holding NV [ASML], a leading provider of lithography systems for the semiconductor industry, and Cymer, Inc. [CYMI], a leading supplier of lithography light sources used by chipmakers to manufacture advanced semiconductor devices, announce that they have entered into a definitive agreement under which ASML will acquire all outstanding shares of Cymer in a cash-and-stock transaction currently valued at EUR 1.95 billion.

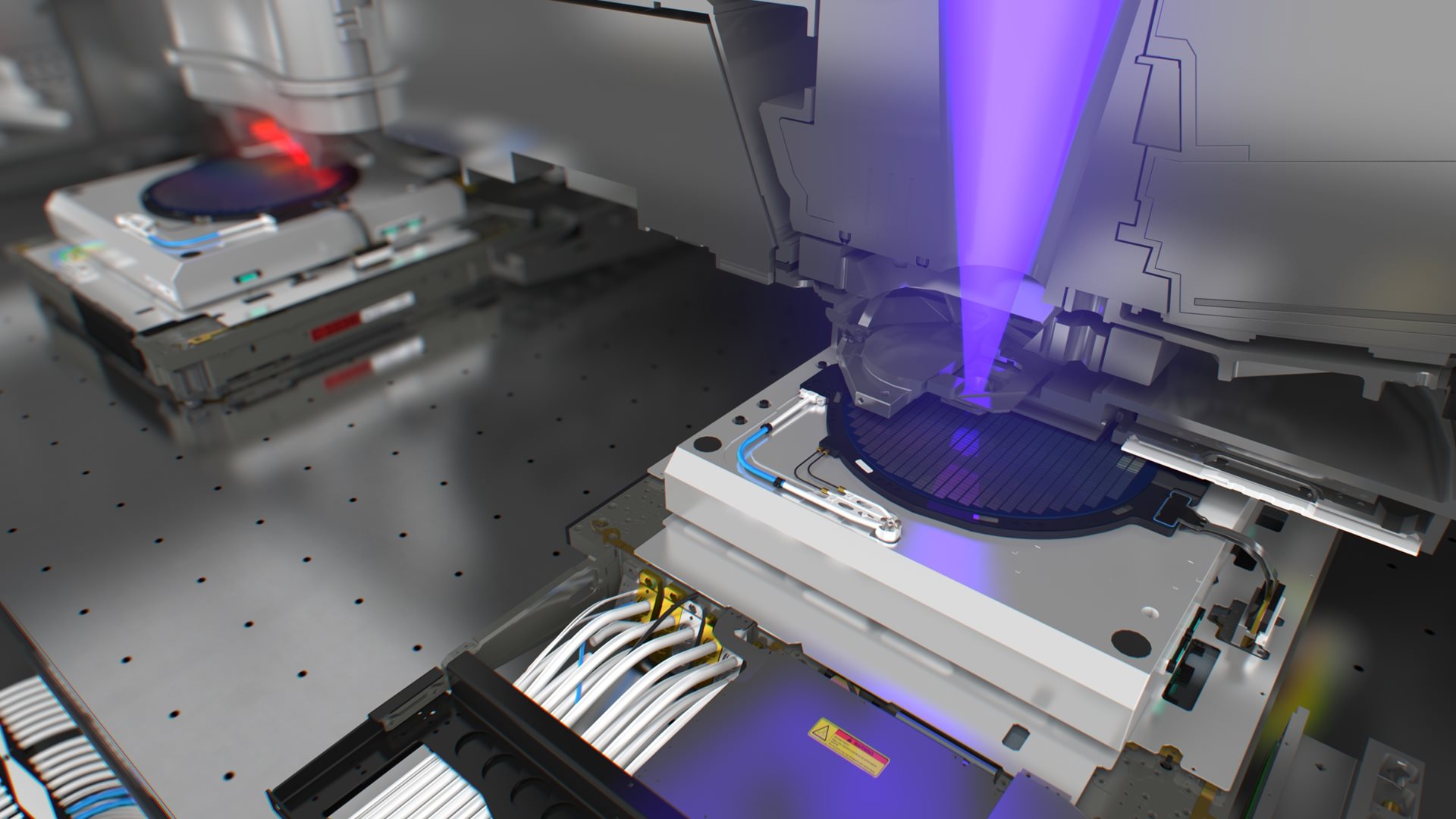

The purpose of the acquisition of Cymer is to accelerate the development of Extreme Ultraviolet (EUV) semiconductor lithography technology. EUV is vital to support the semiconductor industry’s transition to the next manufacturing technology, which is needed to create microchips with more functions at a lower cost and that are more energy-efficient, consistent with Moore’s law.

ASML and Cymer have collaborated closely for over a year, and this merger is the natural evolution of their existing cooperation in developing EUV technology. Combining Cymer’s expertise in EUV light sources with ASML’s expertise in lithography systems design and integration will reduce the risk and accelerate the introduction of this extremely complex technology.

The transaction, which was unanimously approved by the boards of directors of ASML and Cymer, would entitle each Cymer shareholder to receive US$20.00 in cash and a fixed ratio of 1.1502 ASML ordinary shares per Cymer share. The total price reflects a premium of 61% over Cymer's 30-day volume-weighted average price (VWAP) and 52% over its 90-day VWAP, using ASML’s VWAP for the comparable period ending 16 October 2012.

“We believe that this transaction will improve our capabilities to bring new technologies to our customers, and will deliver value to Cymer’s and ASML’s shareholders,” said Eric Meurice, President and Chief Executive Officer of ASML. “We expect the merger to make EUV technology development significantly more efficient and simplify the supply chain and integration flow of the EUV modules. We are also very much encouraged by the opportunities that we expect to create around Cymer’s growing advanced Immersion systems and dry Deep Ultraviolet (DUV) Installed Base Products (IBP) business.”

“Over the last several years, Cymer has been investing significant capital towards developing EUV source technology. We are very encouraged that ASML’s resources will enable the combined company to continue to develop and successfully commercialize EUV on an accelerated time frame,” said Bob Akins, Chairman and Chief Executive Officer of Cymer. “The success of EUV is critical to the semiconductor industry, and we view this merger as very attractive for our shareholders, customers and employees as well as our industry.

As a result of the transaction, ASML will also acquire Cymer’s DUV business. This technology is expected to remain a significant and growing engine of sales and profit and will be well positioned to support and balance customer needs for EUV and immersion multiple patterning. ASML intends to manage Cymer’s commercial operations as an independent division based in the United States, and will continue to deliver and service DUV and EUV sources for all customers on an arm’s length basis. ASML scanners will continue to interface with light sources from all manufacturers.

The transaction is expected to close in the first half of 2013 and is subject to customary closing conditions, including review by U.S. and international regulators and approval by Cymer's shareholders. Excluding non-cash purchase price accounting adjustments, the transaction is expected to be accretive to ASML's EPS in the second year after closing.

EUV status update

- ASML’s six pre-production NXE:3100 EUV systems, capable of resolution performance compatible with the 22 nm node in single patterning mode, have exposed more than 23,000 wafers at customer sites with good overlay and imaging performance, enabling semiconductor device recipe development and confirmation of infrastructure progress. The successor system, the NXE:3300B, is capable of resolution performance compatible with the 14 nm node in single patterning mode. This system has already shown overlay down to 1.3 nm and imaging down to 16 nm in a full-field single exposure using new illumination technology. Progress continues on improving the productivity of the EUV systems currently limited by the light source.

- Cymer’s EUV light sources have for some time been exposing wafers at up to 11 Watts source power at customer facilities, resulting in NXE:3100 productivity of up to 7 wafers per hour. ASML and Cymer jointly made significant progress during the summer and have now proven in laboratories a sustained 30-Watt source exposure power potential, which would enable the NXE:3300B to expose 18 wafers per hour. ASML’s specified target remains at 105 watts or 69 wafers per hour (wph), to be achieved for 2014 microchip production.

- ASML and Cymer have been cooperating very closely for more than a year on a number of development tasks. The transaction is a natural next step from the R&D collaboration and will make the cooperation more efficient by knitting development teams closer together, streamlining project management and simplifying the supply chain.

The current accumulated EUV exposure experience at customers, the successful demonstration of the NXE:3300B imaging and overlay and the proof of concept of up to 30 watts source power are expected to support the following plan:

- The deliveries of the first 11 NXE:3300B systems in 2013 to be installed at customers for R&D.

- Additional orders for NXE:3300B systems intended for production in 2014 at a minimum specification targeting 69 wph. ASML has currently received four commitments and expects another four to eight within the next six months.

About ASML

ASML is one of the world's leading providers of lithography systems for the semiconductor industry, manufacturing complex machines that are critical to the production of integrated circuits or chips. Headquartered in Veldhoven, the Netherlands, ASML is traded on Euronext Amsterdam and NASDAQ under the symbol ASML. ASML has more than 8,200 employees on payroll (expressed in full time equivalents), serving chip manufacturers in more than 55 locations in 16 countries. More information about our company, our products and technology, and career opportunities is available on our website: www.asml.com.

About Cymer

Cymer, Inc. (Nasdaq: CYMI) is an industry leader in developing lithography light sources, used by chipmakers worldwide to pattern advanced semiconductor chips, and is pioneering a new silicon crystallization tool for the display industry. Cymer’s light sources have been widely adopted by the world’s top chipmakers and the company’s installed base comprises approximately 3,750 systems. Continuing its legacy of leadership, Cymer is currently pioneering the industry’s transition to EUV lithography, the next viable step on the technology roadmap for the creation of smaller, faster chips. The company is headquartered in San Diego, CA, has more than 1,200 employees on payroll (expressed in full time equivalents) and supports its customers from numerous offices around the globe. Cymer maintains a Web site to which it regularly posts press releases, SEC filings, and additional information about Cymer. Interested persons can also subscribe to automated e-mail alerts or RSS feeds. Please visit www.cymer.com.

Forward-looking statements

“Safe Harbor” Statement under the US Private Securities Litigation Reform Act of 1995: this press release contains statements that constitute forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. These statements, as they relate to Cymer or ASML, this transaction or the expected benefits of this transaction, involve risks and uncertainties that may cause results to differ materially from those set forth in the statements. We use words such as “anticipates,” “believes,” “plans,” “expects,” “projects,” “future,” “intends,” “may,” “will,” “should,” “could,” “estimates,” “predicts,” “potential,” “continue,” “guidance” and similar expressions to identify these forward-looking statements. These statements are not historical facts, but rather are based on current expectations, estimates, assumptions and projections about the business and future financial results of ASML and Cymer, and readers should not place undue reliance on them. Actual results or developments may differ materially from those in the forward-looking statements. These forward looking statements are subject to risks and uncertainties, including the inability to obtain Cymer shareholder approval or regulatory approval for this transaction, the satisfaction of other conditions to the closing of the transaction, the possibility that the length of time necessary to consummate this transaction may be longer than anticipated, the achievement of the expected benefits of the transaction, risks associated with integrating the businesses of Cymer and ASML, the possibility that the businesses of ASML and Cymer may suffer as a result of uncertainty surrounding the proposed transaction, the expected capacity and capability developments in EUV systems, the anticipated effect of this transaction on ASML’s earnings per share and EUV margins, the benefits of the DUV and IBP businesses and other risks associated with the development of EUV technology.The foregoing risk list of factors is not exhaustive. You should consider carefully the foregoing factors and the other risks and uncertainties that affect the businesses of ASML and Cymer described in the risk factors included in ASML's Annual Report on Form 20-F and Cymer’s Annual Report on Form 10-K, Cymer’s Quarterly Reports on Form 10-Q, and other documents filed by ASML and Cymer from time to time with the SEC. The parties disclaim any obligation to update the forward-looking statements contained herein.

Important information for investors and stockholders

This communication does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval. No offer of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. The proposed transaction will be submitted to the stockholders of Cymer for their consideration. In connection with the proposed transaction, Cymer will file a proxy statement with the SEC and ASML will file a registration statement on Form F-4 with additional information concerning the transaction, including a proxy statement/prospectus. CYMER STOCKHOLDERS ARE ADVISED TO READ THESE DOCUMENTS CAREFULLY (WHEN THEY BECOME AVAILABLE) AND ANY OTHER RELEVANT DOCUMENTS FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION. The proxy statement, the registration statement, and other documents containing other important information about Cymer and ASML filed or furnished to the SEC (when they become available) may be read and copied at the SEC’s public reference room located at 100 F Street, N.E., Washington, D.C. 20549. Information on the operation of the Public Reference Rooms may be obtained by calling the SEC at 1-800-SEC-0330. The SEC also maintains a website, www.sec.gov, from which any electronic filings made by ASML and Cymer may be obtained without charge. In addition, investors and shareholders may obtain copies of the documents filed with or furnished to the SEC upon oral or written request without charge. Requests may be made in writing by regular mail by contacting ASML at the following address: De Run 6501, 5504 DR, Veldhoven, The Netherlands, Attention: Investor Relations, or by contacting Cymer at the following address: 17075 Thornmint Court, San Diego, CA, 92127, Attention: Investor Relations, +1 858 385 6097.Cymer and ASML and their respective directors, executive officers and employees and other persons may be deemed to be participants in the solicitation of proxies in respect of the transaction. Information regarding Cymer's directors and executive officers and their ownership of Cymer common stock is available in Cymer’s proxy statement for its 2012 meeting of stockholders, as filed with the SEC of Schedule 14A on April 11, 2012. Information about ASML's directors and executive officers and their ownership of ASML ordinary shares is available in its Annual Report on Form 20-F for the year ended December 31, 2011 and will be available in the joint proxy statement/prospectus (when available). Other information regarding the interests of such individuals as well as information regarding Cymer's and ASML's directors and officers will be available in the proxy statement/prospectus when it becomes available. These documents can be obtained free of charge from the sources indicated above.