As a global technology leader and employer, we play an active role in the communities we operate in. We partner with neighbors and local organizations to build meaningful relationships so that we can benefit from each other’s growth and thrive together. Our community program is fundamental to our ESG sustainability strategy.

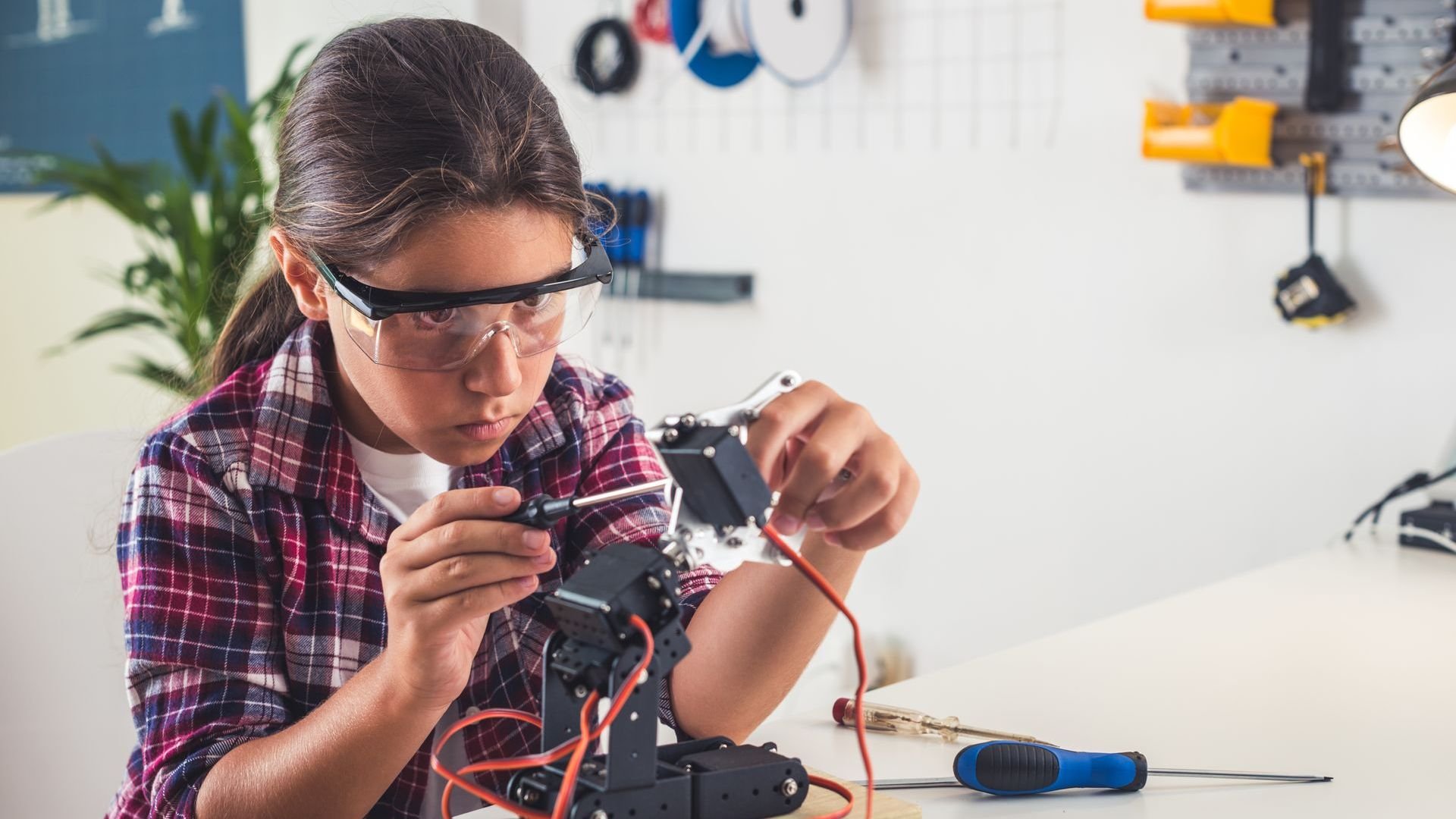

Education

As the world moves closer to a fully digital future, we strive to improve the quality and accessibility of STEM (science, technology, engineering and math) education so that all members of society, especially children, have the opportunity to fulfill their potential.

We organize and support numerous initiatives that aim to share our enthusiasm and expertise in technology to inspire future generations. The ASML Junior Academy, our flagship education program, delivers fun and engaging STEM lessons for primary school classes in collaboration with Mad Science. We also participate in multiple educational events that promote career opportunities in technology, including Dutch Technology Week and Crafted.

Sports, arts and music

Culture is the invisible bond that unites people in a community. We support initiatives and organizations that strengthen those bonds and help open them up for newcomers.

We collaborate with several organizations that have sports, arts and music initiatives in the communities where we work. For example, our experts are working with the Van Gogh Museum in Amsterdam and Van Gogh Brabant to find new ways to preserve historic paintings. We also have a long-term partnership with the Muziekgebouw in Eindhoven, bringing our employees and community members together through a shared passion for the stage.

Local outreach

We want to help strengthen our local communities, supporting initiatives that provide access to basic needs and help unlock the potential of disadvantaged community members.

Our work includes supporting food banks, donating funds to charities and working with environmental organizations on conservation projects to care for those in need and protect our planet. We also recognize the power of volunteers to transform our communities and encourage employees to give back to their communities through our global volunteering program.

Apply for support

We always welcome new opportunities to sponsor activities, initiatives or organizations that align with our community engagement focus areas of education, sports, arts and music, and local outreach.

Contact

For more information on our community engagement activities, please contact community.engagement@asml.com.