Press release - Veldhoven, the Netherlands, May 23, 2006

ASML Holding NV (ASML) today announced that it expects Q2 2006 order entry to be at least 40% higher than Q1 2006 net bookings of 62 lithography systems.

ASML expects its Q2 2006 bookings level to be higher than previously disclosed due to strong customer demand for deliveries in Q4 2006 and Q1 2007.

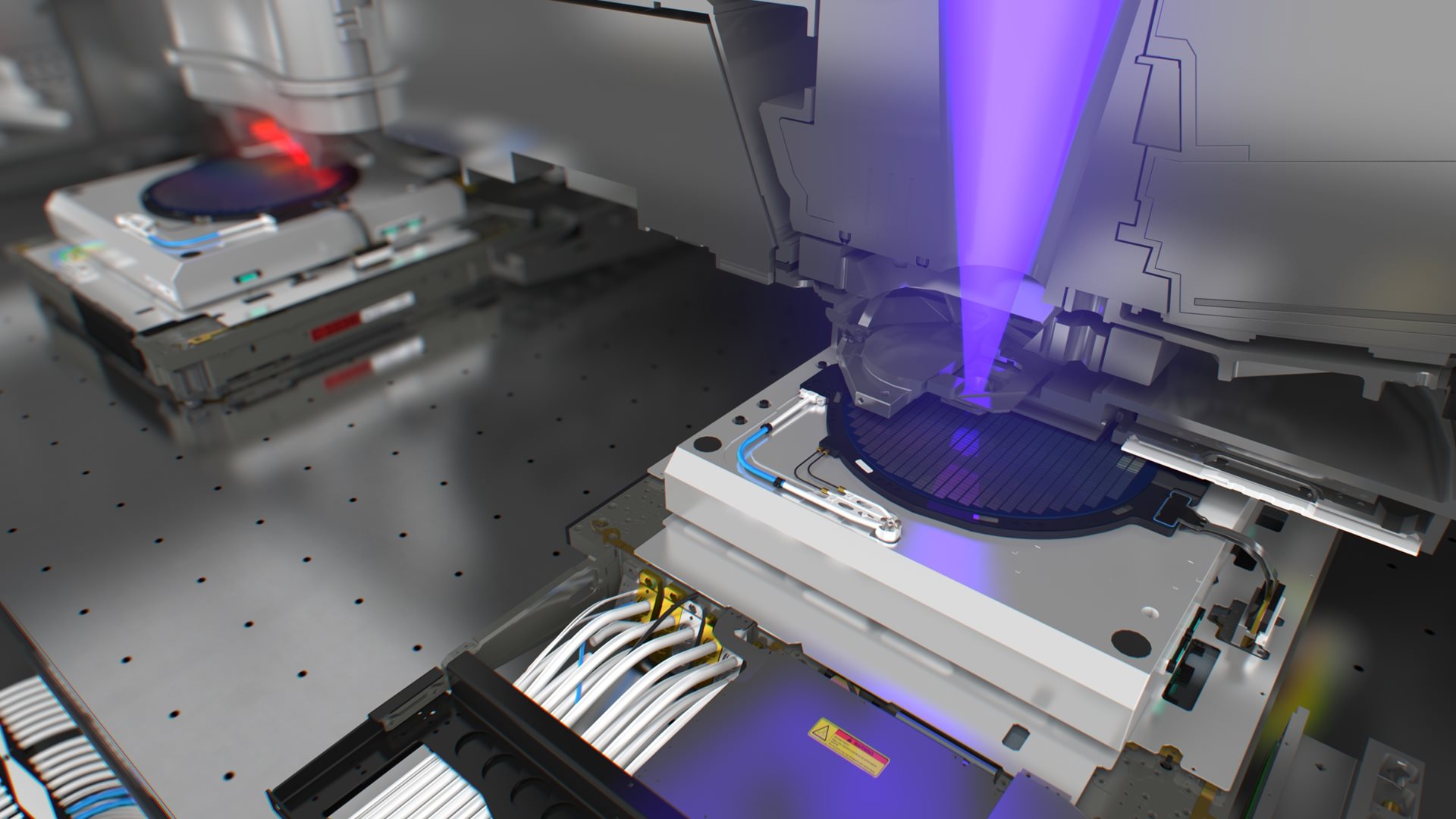

“Our higher than expected Q2 bookings intake further confirms the steady capacity increase need of the semiconductor industry and the growing market acceptance of ASML technology,” said Eric Meurice, president and CEO. “In particular, ASML continues to strengthen its technology leadership through immersion, as customers are starting qualification of our TWINSCAN XT:1700i's capabilities down to the 45-nanometer node.”

In view of the positive outlook of ASML technology and of our customers’ accelerated roadmap needs, we plan to raise Research and Development variable expenses in Q2 2006 to reach a total of €92 million net of credit, an increase of €5 million from previous guidance.

About ASML

Forward-looking statements