Press release - VELDHOVEN, the Netherlands, October 14, 2020

Today ASML Holding NV (ASML) has published its Q3 2020 results.

-

Q3 net sales of €4.0 billion, gross margin of 47.5%, net income of €1.1 billion

-

Q3 net bookings of €2.9 billion

| (Figures in millions of euros unless otherwise indicated) | Q2 2020 | Q3 2020 |

|---|---|---|

| Net sales | 3,326 | 3,958 |

| ...of which Installed Base Management sales 1 | 887 | 862 |

| New lithography systems sold (units) | 57 | 57 |

| Used lithography systems sold (units) | 4 | 3 |

| Net bookings 2 | 1,101 | 2,868 |

| Gross profit | 1,603 | 1,881 |

| Gross margin (%) | 48.2 | 47.5 |

| Net income | 751 | 1,062 |

| EPS (basic; in euros) | 1.79 | 2.54 |

| End-quarter cash and cash equivalents and short-term investments | 4,440 | 4,408 |

(1) Installed Base Management sales equals our net service and field option sales.

(2) Our systems net bookings include all system sales orders for which written authorizations have been accepted (for EUV excluding the High-NA systems).

Numbers have been rounded for readers' convenience. A complete summary of US GAAP Consolidated Statements of Operations is published on www.asml.com

CEO statement and outlook

"Our third-quarter sales came in at €4.0 billion, which is above our guidance. Our gross margin was within guidance at 47.5%. We shipped 10 EUV systems and were able to recognize revenue for 14 systems in the third quarter. We have seen no major disruptions due to COVID-19 during the last quarter. Our Q3 net bookings came in at €2.9 billion, including €595 million from EUV systems (4 units).

"We expect fourth-quarter revenue of between €3.6 billion and €3.8 billion with a gross margin of around 50%, R&D costs of €550 million and SG&A costs of €140 million. Our outlook for the full year 2020 is therefore confirmed. The estimated annualized effective tax rate is around 14% for 2020.

"For 2021, we expect low double-digit growth. There are of course uncertainties due to the macro environment, including the economic impact of COVID-19 and geopolitical developments. However, the secular end market drivers are still in place (such as 5G, AI and high-performance computing) which fuel demand for advanced process nodes both in Logic and Memory, requiring advanced lithography," said ASML President and Chief Executive Officer Peter Wennink.

Products and business highlights

-

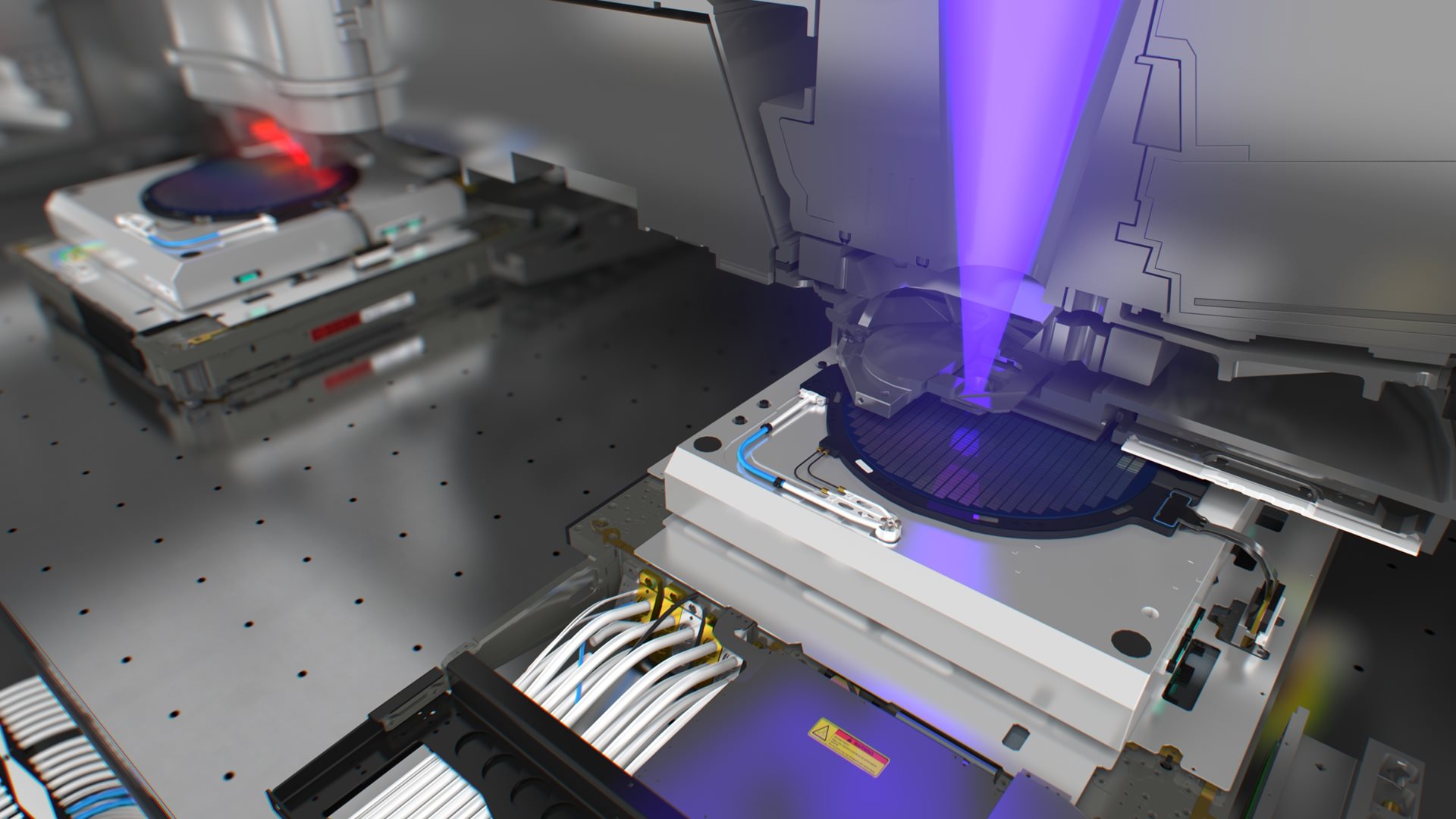

In our DUV lithography business, we qualified the first TWINSCAN NXT:2050i in Q3, which shipped in early Q4. The NXT:2050i is based on a new version of the NXT platform, which includes new developments in the reticle stage, wafer stage, projection lens and exposure laser. Thanks to these innovations, the system delivers better overlay control at a higher productivity than its predecessor. The NXT:2050i will enter volume manufacturing immediately.

-

In our EUV business, the vast majority of the TWINSCAN NXE:3400B systems in the field have now been upgraded with productivity packages.

-

We announced the final specification for the TWINSCAN NXE:3600D, a new system on the EUV roadmap that will offer an 18% productivity improvement, reaching 160 wph at 30 mJ/cm2 and an improved matched machine overlay of 1.1 nm. Shipments are planned for mid-2021.

Interim dividend and share buyback program update

The interim dividend for 2020 will be €1.20 per ordinary share. The ex-dividend date as well as the fixing date for the EUR/USD conversion will be November 2, 2020, and the record date will be November 3, 2020. The dividend will be made payable on November 13, 2020.

As part of its financial policy to return excess cash to its shareholders through growing annualized dividends and regularly timed share buybacks, in January 2020, ASML announced a new three-year share buyback program, to be executed within the 2020–2022 time frame. As part of this program ASML intends to purchase shares up to €6 billion, which includes a total of up to 0.4 million shares to cover employee share plans. ASML intends to cancel the remainder of the shares repurchased. To date, €507 million worth of shares has been repurchased under the current program. Following the pause in the execution of the program in the first quarter of this year, ASML did not execute share buybacks in the second and third quarter. The three-year share buyback program remains in place and ASML will resume executing share buybacks this week.

Quarterly video interview, investor and media conference call

With this press release, ASML has published a video interview in which CFO Roger Dassen discusses the Q3 2020 results. This can be viewed on www.asml.com.

A conference call for investors and media will be hosted by CEO Peter Wennink and CFO Roger Dassen on October 14, 2020 at 15:00 Central European Time / 09:00 US Eastern Time. Details can be found on the ASML Q3 2020 results page.

About ASML

US GAAP Financial Reporting

Regulated Information

Forward Looking Statements